How to Sell a Car with an Outstanding Loan Balance: A Comprehensive Guide

Exploring the intricacies of selling a car with an outstanding loan balance can be a daunting task for many. This guide aims to break down the process into manageable steps, providing valuable insights and tips along the way.

Delving into the complexities of navigating the sale of a vehicle with an existing loan, this guide offers practical advice and solutions to common challenges faced by sellers in this situation.

Understanding the Situation

When selling a car with an outstanding loan balance, it means that the seller has not yet fully paid off the loan taken to purchase the vehicle. This situation presents unique challenges and risks that need to be carefully considered.

Implications of Selling a Car with a Loan

One major implication of selling a car with a loan is that the seller must pay off the remaining balance of the loan before transferring ownership to the buyer. This can complicate the selling process and potentially deter buyers who may prefer to purchase a car without any existing financial obligations attached to it.

Challenges and Risks

- Difficulty in finding a buyer willing to take on a car with an outstanding loan, as they may be concerned about the potential financial liabilities.

- Potential for the remaining loan balance to exceed the car's current market value, resulting in the seller needing to cover the difference out of pocket.

- Risk of defaulting on the loan if the seller is unable to pay off the balance after selling the car, leading to negative consequences on their credit score and financial stability.

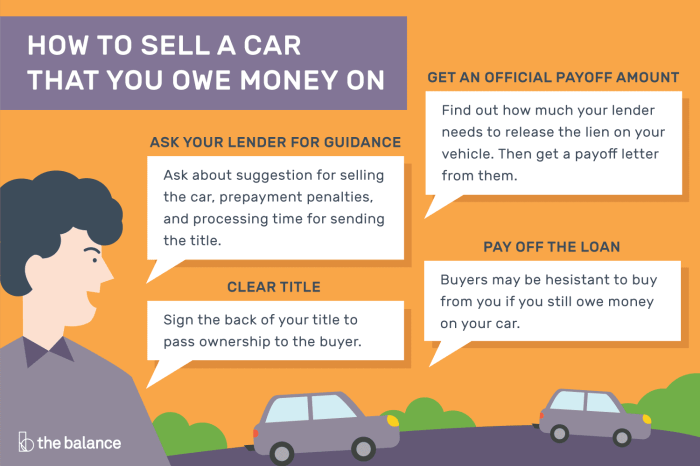

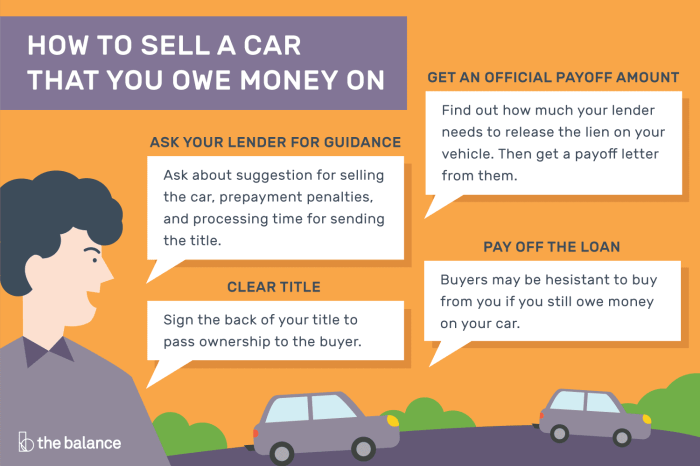

Steps to Take Before Selling

Before selling a car with an outstanding loan, there are crucial steps that need to be taken to ensure a smooth transaction and avoid any complications. One of the most important aspects is understanding the financial obligations tied to the existing loan on the vehicle.

Obtaining the Current Loan Payoff Amount

When selling a car with an outstanding loan balance, it is essential to contact the lender to obtain the current loan payoff amount. This amount represents the total sum needed to pay off the remaining balance on the loan. It is crucial to have this information to accurately determine the financial implications of the sale.

- Reach out to the lender to request the current loan payoff amount.

- Clarify any additional fees or charges that may apply upon early repayment.

- Ensure that the payoff amount is valid for a certain period to complete the sale.

Determining the Car's Market Value Despite the Existing Loan

Despite having an outstanding loan on the car, it is crucial to determine the vehicle's market value accurately. This value will help you understand the equity in the car and whether it is sufficient to cover the loan payoff amount.

Consider using online tools and resources to determine the fair market value of the car based on its make, model, year, and condition.

- Research similar vehicles in the market to gauge the selling price range.

- Take into account any additional features or upgrades that may affect the car's value positively.

- Consult with professionals or appraisers to get an accurate assessment of the car's worth.

Communicating with the Lender

When selling a car with an outstanding loan balance, it is crucial to communicate effectively with the lender to ensure a smooth transaction. By keeping the lender informed and following the necessary steps, you can avoid any complications that may arise during the process.

Obtaining a Payoff Quote

To obtain a payoff quote from the lender, you will need to contact them directly. This quote will provide you with the exact amount needed to pay off the remaining balance on your car loan. You can usually request this information online, over the phone, or by visiting a local branch of the lending institution.

It is essential to obtain this quote before finalizing the sale of your car to ensure that you have all the necessary funds to clear the debt.

Steps for a Smooth Transaction

- Notify the Lender: Inform the lender of your intention to sell the car and request the payoff amount.

- Coordinate with the Buyer: Work with the buyer to ensure that the payment is made directly to the lender to clear the outstanding balance.

- Transfer of Title: Once the lender confirms the loan has been paid off, complete the necessary paperwork to transfer the title to the new owner.

- Follow Up: After the sale, make sure to follow up with the lender to ensure that the loan has been closed and all paperwork is in order.

Finding a Buyer

Finding a buyer for a car with an outstanding loan balance can be a challenging task, but with the right approach, you can successfully sell your vehicle. Whether you choose to sell privately or through a dealership, there are strategies you can use to attract potential buyers and negotiate a fair deal.

Selling Privately

Selling your car privately gives you more control over the selling process and allows you to potentially get a higher price for your vehicle

- Advertise your car on online platforms such as Craigslist, Facebook Marketplace, or AutoTrader to reach a larger audience.

- Highlight the features and benefits of your car in your listing to attract potential buyers.

- Be transparent about the outstanding loan balance and provide clear information about the terms of the loan.

- Arrange test drives for interested buyers and be prepared to answer any questions they may have about the loan.

- Negotiate the sale price based on the market value of your car and the remaining loan balance.

Selling Through a Dealership

Selling your car to a dealership can be a quicker and more convenient option, but you may not get as much money for your vehicle. Here are some strategies for selling your car through a dealership:

- Visit multiple dealerships to get quotes for your car and compare offers to ensure you are getting a fair price.

- Be upfront about the outstanding loan balance and provide all necessary documentation to the dealership.

- Consider trading in your car for a new vehicle to simplify the selling process.

- Negotiate with the dealership to get the best possible price for your car, taking into account the remaining loan balance.

Negotiating with Potential Buyers

When negotiating with potential buyers, it is important to be honest and transparent about the outstanding loan balance. Here are some tips for negotiating a fair deal:

- Explain the situation to the buyer and provide documentation to support the information about the loan.

- Listen to the buyer's concerns and address any questions they may have about the loan balance.

- Be willing to negotiate on the price to reach a mutually beneficial agreement for both parties.

- Consider offering incentives such as a discount or additional features to sweeten the deal for the buyer.

Completing the Sale

When selling a car with an outstanding loan balance, it is crucial to follow the necessary steps to ensure a smooth transfer of ownership and correct handling of the loan payoff. Completing the sale involves several key processes that need to be carefully managed to protect both the seller and the buyer.

Transferring Ownership to the Buyer

- Once you have found a buyer for the car, you will need to transfer the ownership of the vehicle to them. This typically involves signing over the title of the car to the new owner.

- Make sure to accurately fill out all the necessary paperwork for the transfer of ownership. This may include a bill of sale and other documentation required by your state's Department of Motor Vehicles.

- Ensure that both you and the buyer sign all the relevant documents to legally transfer the ownership of the vehicle.

Ensuring Loan Payoff and Title Transfer

- Before finalizing the sale, contact your lender to determine the exact amount needed to pay off the remaining loan balance. This amount may include the outstanding principal, accrued interest, and any prepayment penalties.

- Once you have the payoff amount, work with the buyer to ensure that the loan is paid off in full. This can be done by using the funds from the sale of the car to settle the remaining balance with the lender.

- After the loan is paid off, the lender will release the lien on the car, allowing you to transfer the title to the buyer. Make sure to obtain a lien release document from the lender to provide proof that the loan has been satisfied.

Conclusive Thoughts

In conclusion, selling a car with an outstanding loan balance requires careful planning and strategic communication with all parties involved. By following the steps Artikeld in this guide, sellers can navigate this process smoothly and successfully.

Frequently Asked Questions

What steps should be taken before selling a car with an outstanding loan balance?

Before selling a car with a remaining loan balance, it's crucial to obtain the current loan payoff amount, determine the car's market value, and communicate with the lender to understand the process.

Is it possible to sell a car with an outstanding loan balance privately?

Yes, it is possible to sell a car with an outstanding loan balance privately. However, it's important to ensure that the loan is paid off correctly and the title is transferred to the new owner seamlessly.

How can one negotiate effectively with potential buyers when selling a car with an outstanding loan balance?

When negotiating with potential buyers in this scenario, it's essential to be transparent about the existing loan and discuss options for loan payoff. Clear communication and honesty can facilitate a smoother negotiation process.