How to Choose Between Leasing and Financing a Vehicle: A Comprehensive Guide

Exploring the decision between leasing and financing a vehicle opens up a world of possibilities and considerations. This guide aims to provide a detailed overview of the factors, affordability comparisons, flexibility, ownership, resale value, and depreciation aspects to help you make an informed choice.

Delve into the nuances of each option and gain valuable insights into the financial implications and long-term commitments associated with your decision.

Factors to Consider

When deciding between leasing and financing a vehicle, there are several key factors to consider that can impact your financial situation and overall experience. Let's explore the main differences between the two options and what you should keep in mind.

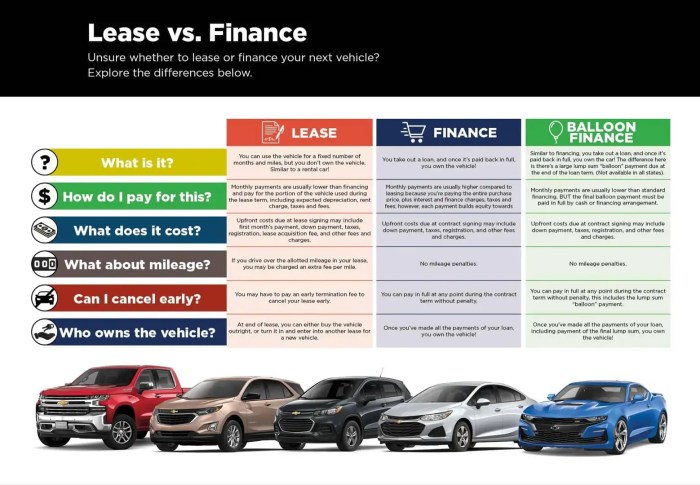

Key Differences Between Leasing and Financing

- Leasing involves essentially renting a vehicle for a specific period, usually 2-4 years, with mileage restrictions and no ownership at the end of the term. On the other hand, financing allows you to own the vehicle once you complete all payments.

- With leasing, you may have lower monthly payments compared to financing, but you won't build equity in the vehicle. Financing, on the other hand, involves higher monthly payments but leads to eventual ownership of the vehicle.

Financial Implications

- Leasing typically requires a lower upfront payment and lower monthly payments, making it a more budget-friendly option initially. However, you may face additional fees for exceeding mileage limits or wear and tear on the vehicle.

- Financing involves higher upfront costs and monthly payments, but you are investing in ownership of the vehicle, which can have long-term financial benefits as you build equity.

Impact of Mileage Limits

- Leasing comes with strict mileage limits, usually between 10,000 to 15,000 miles per year. Exceeding these limits can result in costly fees at the end of the lease. Financing, on the other hand, allows you to drive as much as you want without restrictions.

- If you have a long commute or enjoy road trips, financing might be a better option to avoid mileage penalties associated with leasing.

Maintenance Responsibilities

- When you lease a vehicle, you are typically responsible for basic maintenance and upkeep, but major repairs may be covered under warranty. With financing, you own the vehicle and are responsible for all maintenance and repair costs, which can add up over time.

- Consider your driving habits, budget for maintenance, and whether you prefer the convenience of a warranty-covered lease or the control of owning your vehicle when making your decision.

Affordability Comparison

When deciding between leasing and financing a vehicle, affordability is a crucial factor to consider. Let's delve into the financial aspects of both options to help you make an informed decision.

Monthly Payments

When you lease a vehicle, your monthly payments are typically lower compared to financing. This is because you are essentially paying for the depreciation of the car during the lease term, rather than the full purchase price. On the other hand, financing a vehicle involves higher monthly payments as you are paying off the entire cost of the car over the loan term.

Upfront Costs

Leasing usually requires lower upfront costs compared to financing. These upfront costs for leasing may include a security deposit, the first month's payment, taxes, registration fees, and any other applicable fees. Financing, on the other hand, often requires a down payment, taxes, registration fees, and other costs associated with purchasing a vehicle.

Long-Term Cost Implications

In the long run, leasing may end up being more expensive than financing if you continue to lease vehicles without ever owning one. When you finance a vehicle, once you pay off the loan, you own the car outright and no longer have monthly payments.

However, if you constantly lease, you will always have a monthly payment for as long as you continue leasing.

Total Cost Comparison

To provide a clear comparison between leasing and financing in terms of total costs over a specified period, let's consider a hypothetical scenario over a 3-year period. Below is a table outlining the total costs for leasing and financing a vehicle.

| Leasing | Financing | |

|---|---|---|

| Monthly Payments | $300 | $400 |

| Upfront Costs | $2,000 | $4,000 |

| Total Cost Over 3 Years | $12,800 | $16,400 |

This table illustrates the difference in total costs between leasing and financing a vehicle over a 3-year period, taking into account monthly payments and upfront costs.

Flexibility and Ownership

Leasing and financing both offer different levels of flexibility and ownership when it comes to acquiring a vehicle. Let's explore the key points to consider.

Flexibility in Vehicle Choice and Duration

When it comes to leasing, you have the flexibility to choose from a wide range of vehicles without committing to ownership for an extended period. Leasing allows you to drive a new car every few years, providing variety and the opportunity to experience different models.

On the other hand, financing gives you the freedom to choose any vehicle you desire without mileage restrictions or excessive wear and tear concerns.

Benefits of Ownership with Financing

Financing a vehicle comes with the significant benefit of ownership. Once you complete your loan payments, you fully own the vehicle and can keep it for as long as you want. This ownership provides a sense of pride and allows you to customize the vehicle to your liking, whether through modifications or personal touches.

Easier Upgrades with Leasing

Leasing enables easier upgrades to newer models compared to financing. Since lease terms typically last a few years, you can easily transition to the latest vehicle models without the hassle of selling or trading in a car you own. This flexibility appeals to individuals who prefer driving the latest technology and features available in newer vehicles.

Modifications and Customization Differences

When it comes to modifications and customization, financing offers more freedom compared to leasing. With financing, you can make changes to the vehicle's appearance or performance to suit your preferences. However, in a leased vehicle, you are generally restricted from making significant modifications that alter the original condition of the car.

This limitation ensures the vehicle retains its value and condition for when you return it at the end of the lease term.

Resale Value and Depreciation

When deciding between leasing and financing a vehicle, considering the impact of resale value and depreciation is crucial. Resale value is the amount of money you can expect to receive when selling or trading in your vehicle, while depreciation refers to the decrease in value over time.

Impact of Vehicle Depreciation

Vehicle depreciation plays a significant role in the decision-making process. When you finance a car, you are responsible for the vehicle's depreciation, which can affect your equity in the long run. On the other hand, when leasing, the leasing company assumes the risk of depreciation, providing you with a more predictable cost structure.

Ownership vs. Leasing and Resale Value

Ownership of a vehicle can impact its resale value compared to leasing. Generally, owned vehicles tend to have higher resale values since they are typically maintained better than leased vehicles. This can be an important factor to consider when choosing between leasing and financing.

Minimizing Financial Losses Due to Depreciation

- Opt for a vehicle with a good reputation for retaining value.

- Take good care of your vehicle to maintain its condition.

- Consider purchasing GAP insurance to cover the difference between the vehicle's value and what you owe in case of depreciation.

- Make a larger down payment to reduce the overall loan amount and decrease the impact of depreciation.

Assessing Future Resale Value

- Research the historical depreciation rates of the vehicle make and model you are considering.

- Consider the demand for the vehicle in the used car market.

- Factor in any potential modifications or upgrades that could affect resale value.

- Consult with automotive experts or use online tools to estimate the future resale value of the vehicle.

Epilogue

In conclusion, weighing the pros and cons of leasing versus financing allows you to tailor your choice to suit your specific needs and financial goals. By understanding the intricacies of each option, you can confidently navigate the path towards acquiring your next vehicle.

Q&A

What are the key differences between leasing and financing?

Leasing involves essentially renting a vehicle for a set period with mileage restrictions, while financing entails taking a loan to purchase the vehicle with ownership at the end of payments.

How do monthly payments compare between leasing and financing?

Monthly payments for leasing are typically lower than financing since you're only paying for the vehicle's depreciation during the lease term. Financing involves paying off the total purchase price.

What impact does vehicle depreciation have on the decision to lease or finance?

Depreciation affects both options, but it's more critical in leasing as the vehicle's value at the end of the lease term determines various costs. Financing allows you to build equity in the vehicle.

How does ownership affect resale value?

Ownership typically leads to higher resale value since you own the vehicle and can sell it at any time. In leasing, the leasing company retains ownership.

What strategies can be used to minimize financial losses due to depreciation?

Opting for a shorter lease term, maintaining the vehicle well, and being mindful of mileage limits can help minimize financial losses due to depreciation in leasing. In financing, making a larger down payment can mitigate depreciation effects.